Personal loans are an effective financial tool to manage urgent expenses, fund personal projects, or even consolidate debt. However, borrowing responsibly requires understanding the repayment process, monthly commitment, and the interest cost involved. This is where a personal loan EMI calculator comes into play. It simplifies the calculation process, enabling borrowers to make informed financial decisions, plan their budgets, and manage loans effectively.

In this article, we’ll discuss what a personal loan EMI calculator is, how it works, and how to use it to calculate factors like pre-EMI payments and total repayment costs.

What Is a Personal Loan EMI Calculator?

A personal loan EMI calculator is a digital tool that helps borrowers compute their Equated Monthly Installments (EMIs) quickly and accurately. This online calculator is designed to eliminate manual errors and give you a clear picture of your loan repayment plan. It is accessible via lender websites, mobile apps, or third-party financial platforms.

When you input the loan amount, interest rate, and tenure, the calculator instantly displays the EMI you need to pay every month toward your loan. It effectively helps borrowers understand their financial commitments and design repayment schedules that suit their budget.

The Components of EMI Calculation

Let’s break down the components involved in calculating your personal loan EMI:

Principal Amount

The loan amount you wish to borrow from the lender.

Interest Rate

The percentage charged by the lender on the borrowed amount.

Tenure

The loan repayment period, usually ranging between 12 and 60 months for personal loans.

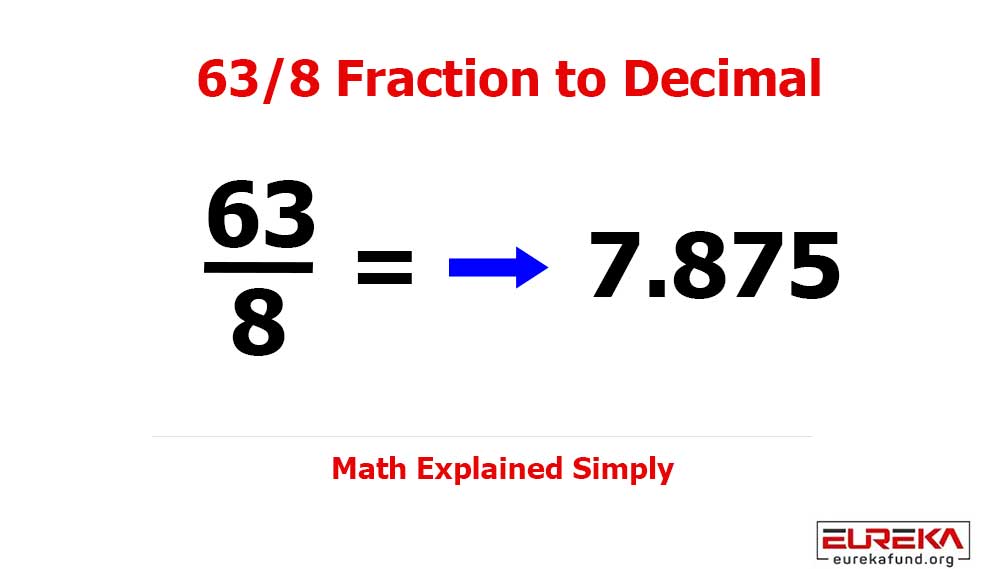

EMI Formula

[EMI = \frac{P \times r \times (1 + r)^n}{(1 + r)^n – 1}]

Here, P is the principal amount, r is the monthly interest rate (annual interest/12/100), and n is the loan tenure in months.

While manually using the formula can be labor-intensive, the personal loan EMI calculator efficiently handles these calculations, ensuring precision and convenience.

Benefits of Using a Personal Loan EMI Calculator

Using a personal loan EMI calculator has various advantages:

Plan Your Monthly Budget

The calculator enables you to determine the exact EMI amount to be paid each month. Knowing this figure helps borrowers plan their monthly expenses and avoid financial strain during the repayment period.

Calculate Interest Costs

By using the tool, you can gauge the total interest expense for your loan. This empowers borrowers to negotiate better interest rates with lenders and reduce overall borrowing costs.

Compare Loan Offers

A personal loan EMI calculator allows you to compare different loan offers based on their EMIs, interest rates, and tenure. This helps you pick the most suitable loan option.

Avoid Errors in Calculation

The manual computation of EMIs can lead to errors, especially when dealing with complex formulas or multiple loans. A calculator ensures error-free calculations.

Understand Pre-EMI Payments

Sometimes, loans involve pre-EMI payments—interest payments made before complete EMI-based repayments begin. A personal loan EMI calculator can account for these initial payments, giving you a complete picture of the repayment structure.

How to Use the Personal Loan EMI Calculator

Using an EMI calculator is straightforward. Follow the steps below to make the most out of this tool:

Input the Loan Amount

Enter the principal amount you plan to borrow from the lender.

Enter the Interest Rate

Provide the applicable interest rate for your loan.

Specify the Tenure

Select the loan tenure in months or years.

Review the Calculator’s Output

The calculator will display:

- Your EMI amount

- The total interest payable

- The overall loan repayment amount (including interest)

You can experiment with different values for the loan amount, interest rate, and tenure to find an EMI figure that suits your budget.

Learn About Pre-EMI Payments

When opting for certain loans, especially with delayed disbursements (e.g., for under-construction property), borrowers may only pay pre-EMI for a specified period. Pre-EMI refers to interest payments made during this phase. While pre-EMI payments help borrowers manage cash flow without full EMIs, they do increase the total interest payout.

Using an EMI calculator can help you calculate pre-EMI payments alongside the standard EMIs to understand the potential financial implication of your loan. This transparency ensures borrowers are well-prepared for any hidden costs.

Practical Applications of the EMI Calculator

Planning for Multiple Loans

If you’re juggling multiple debts, the EMI calculator can help you create a repayment strategy that streamlines your financial obligations. Understand your monthly commitments for different loans and prioritize repayments accordingly.

Assessing Loan Tenure

The calculator can help you evaluate the impact of tenure changes on your EMI. For example, a longer tenure reduces the EMI amount but increases the overall interest cost. Conversely, shorter tenures demand higher EMIs but reduce interest expenses. This comparative analysis aids in making practical decisions.

Scenario Testing

Experimenting with your loan variables through the calculator lets you test various scenarios, like higher loan amounts or variable interest rates. This prepares borrowers to face fluctuations in economic conditions or lender policies.

Tips to Minimize EMI and Interest Costs

While the EMI calculator gives clear figures, borrowers often seek ways to reduce financial strain. Here are some practical tips:

Opt for a Shorter Tenure

Though the EMI might increase, a shorter tenure significantly reduces interest payment.

Prepay When Possible

Whenever you have surplus funds, consider making part-prepayments to reduce the principal balance and, consequently, the interest payable.

Negotiate Better Rates

Use the calculator to determine if a lender’s interest rate is competitive. If not, negotiate or switch lenders for better terms.

Calculate Pre-EMI Impact

Thoroughly account for pre-EMI payments and choose loans with minimal pre-EMI periods when possible.

Conclusion

A personal loan EMI calculator is a fantastic companion for effective financial planning. It empowers borrowers to make informed decisions regarding their repayment schedules, assess total interest costs, and understand pre-EMI payments. Whether you’re comparing loan offers or budgeting for monthly expenses, this tool ensures convenience, accuracy, and transparency.

Before applying for a personal loan, invest time in calculation and scenario planning through an EMI calculator. By doing so, you’ll set clear expectations for loan repayment and ensure your borrowing journey remains smooth and stress-free. Start using a personal loan EMI calculator today to stay ahead in your financial planning!