Trading has changed in many ways over the years. One of the biggest changes is the move from manual systems to cloud-powered tools. A cloud-based Trader AI platform helps traders act quickly, think clearly, and trade wisely. It removes many limits of old software and replaces them with speed, balance, and smart design. This platform works online and runs nonstop. It helps users execute trades better with less effort.

A cloud-driven AI system does not sleep or slow down. It watches the market at all hours and responds to changes within seconds. This gives traders a cleaner path to act on market moves with more control and less stress.

Cloud-Based AI Trading Platform with Real-Time Market Execution

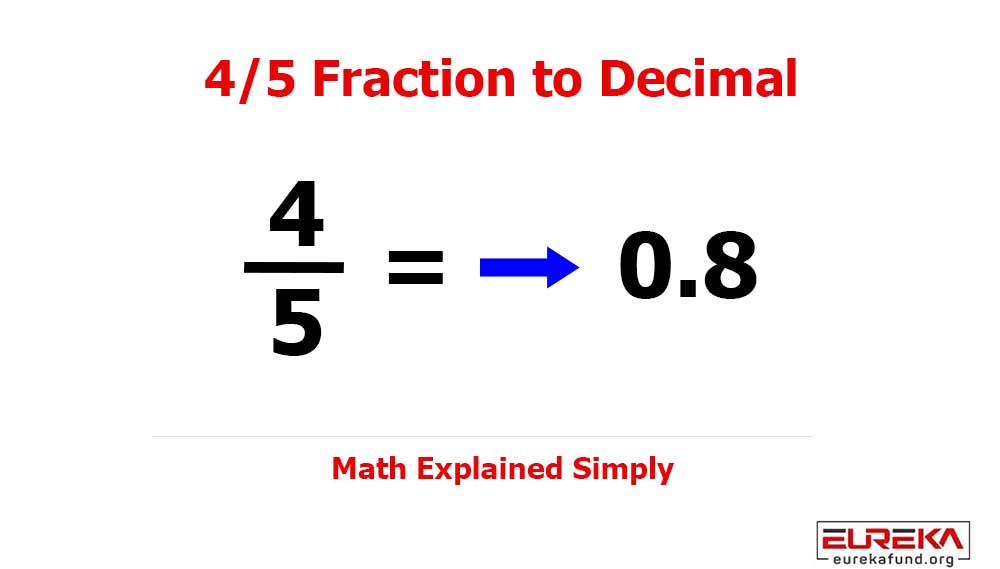

A cloud-based AI trading platform enables trades to execute in real-time. This means trades happen the moment conditions are right. Cloud platforms are always connected to the market. They don’t pause or limit devices as desktop software. This constant link helps avoid delays that can affect trade results.

Always-Connected Market Access

The platform works in the cloud, which enables it to be operational even when the trader is not active. This means trade rules and AI logic continue working day and night. The system does not rely on personal computers, power supply, or manual action. It stays active during fast market shifts and reacts without hesitation.

Faster Trade Placement

Real-time execution means orders go out right away after the AI confirms an entry or exit point. The quick response to an opportunity reduces lag time, and traders do not miss chances or place trades at poor pricing. Also, when trades are accomplished quickly, the chances of slippage in rapidly moving markets are significantly reduced.

Balanced Market Decisions

The AI reads price movement, volume changes, and trend signals together. Instead of reacting to a single indicator, it forms a blended view of the market. This leads to calmer and more balanced execution choices that fit the trader’s settings.

AI-Powered Cloud Trader Software for Automated Smart Order Execution

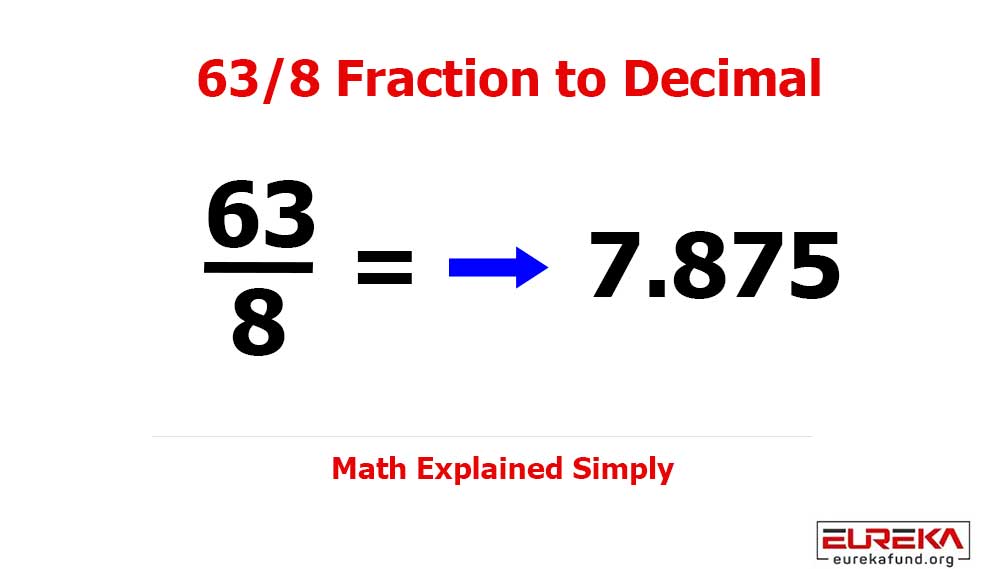

AI-powered cloud trader software for automated smart order execution removes guesswork from trading. Instead of clicking buttons or watching charts all day, traders set rules and let the AI act. The software follows these rules with focus and consistency.

Rule-Based Automation

Traders can define entry levels, exit targets, and risk limits. Once set, the AI follows these rules without emotion. It does not chase losses or hold trades out of hope. This rule-first method helps keep trading steady and planned.

Smart Order Handling

The AI can split orders, adjust timing, or delay execution based on market depth. This smart handling helps reduce sudden price impact. Orders are placed with care rather than force, which supports smoother market entry.

Emotion-Free Trading Flow

Human emotions often cause rushed or delayed trades. AI-powered software removes this burden. Each action follows data and logic, not fear or excitement. This creates a calmer trading flow and supports long-term discipline.

Secure Cloud-Based Trader AI System for Precision Market Strategies

A secure, cloud-based trader AI system emphasises safety and speed in precision market strategies. Strong protection layers and careful system design help guard both data and trades. This builds trust and supports stable use over time.

Encrypted Data Protection

Cloud-based AI systems use encrypted channels to protect user data. Trade settings, account links, and strategy rules remain locked behind security layers. This lowers the risk of data leaks or unwanted access.

Controlled Strategy Execution

Precision strategies depend on exact timing and clear logic. The AI follows pre-set rules closely and avoids random actions. Each trade is placed with purpose, based on defined market conditions.

Stable System Performance

Cloud systems spread workload across secure servers. This helps prevent crashes or system freezes during busy market hours. Stability ensures that strategies keep running even during sharp price swings.

How Smart Market Execution Improves Trading Outcomes

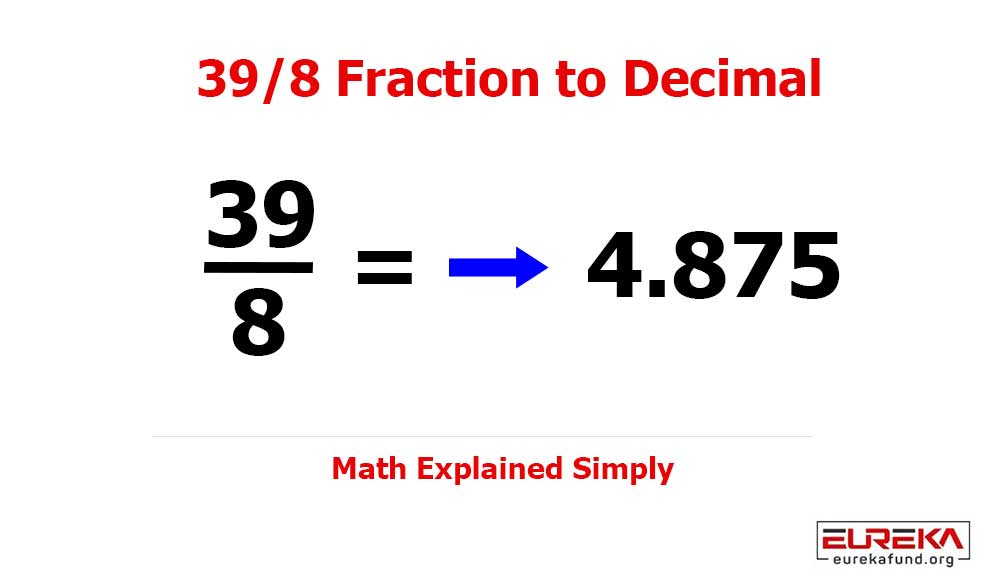

Smart market execution is about placing trades with care and timing. AI-driven cloud platforms aim to improve how and when orders are executed, not just how often.

Reduced Reaction Delay

Markets move quickly. Smart execution reduces the time between signal detection and order placement. This helps capture better prices and avoids late entries.

Cleaner Exit Management

AI systems can manage exits based on logic rather than panic. They close trades when targets are met or risk limits are reached. This helps protect gains and control losses.

Consistent Trade Behaviour

It is difficult for humans to stay consistent, but not for AI. The AI system carries out each trade smartly, following the same rules. This creates a smoother trading rhythm.

The Role of Cloud Technology in Trading Efficiency

Cloud technology improves trading efficiency by removing delays and limits. It allows AI systems to process large data sets quickly and act without pause.

Continuous System Updates

Cloud platforms update in the background. New features, fixes, and security improvements roll out without user action. This keeps the system fresh and reliable.

Shared Processing Power

Cloud systems use multiple servers simultaneously. They do not depend on a single device. This way, they can accomplish data analysis in a very short time. This also supports faster decision-making.

Reduced Downtime

Cloud-based systems can work constantly without stopping. When one server goes down, another keeps working to ensure smooth operation. This keeps trading strategies active without interruption.

Who Can Benefit from a Cloud-Based Trader AI Platform

Many types of traders can benefit from this technology. It is not limited to experts or institutions.

New Traders

Beginners gain structure and guidance. The AI helps them follow rules and avoid emotional mistakes while they learn.

Busy Traders

Those with limited time can rely on automation. The system watches the market and executes trades without constant supervision.

Strategy-Focused Traders

Traders who enjoy planning strategies can focus on design rather than execution. The AI handles the action while they refine logic.

Conclusion

A cloud-based Trader AI platform helps you trade smartly. It offers clear and controlled market execution. These systems support traders with real-time execution and smart order handling. They offer secure strategies for secure trading accomplishment. This helps them work smartly in fast markets. Cloud strength and AI logic work together. This combo makes trading a smooth experience. It focuses on accuracy instead of pressure. Cloud-based AI trading platforms offer a robust and future-focused solution in an ever-changing market environment. They help traders act with purpose and cut down on noise. Traders can follow a better trading path by taking one smart move at a time.