People have to deal with multiple finances considering their needs in the present world. While being busy working throughout the day, individuals still look to get loans. These extra amounts help them cover their unexpected finances or start a new business. It provides them the opportunity to achieve their goals and ambitions. In this digital era, these loans are accessible through digital lending platforms and fintech companies. Those who need quick access to cash can rely on short-term loans as these help the individuals pay their bills or businesses.

Uncle Buck Loans is one such UK-based company giving rapid access to cash by lending short-term loans. They have become a reliable and trusted company in the UK’s short-term lending market. This post will help you explore everything about Uncle Buck loans, how they work, the types of loans, the charges they apply, their repayment policy, etc. So, continue reading if you’re willing to get a detailed guide on Uncle Buck Loans.

What are Uncle Buck Loans?

Uncle Buck Loans is among the successful loan companies established in 2004 and based in the United Kingdom. This offer is known for being a direct lender and providing online short-term loans to its customers. The company is authorized and regulated by the Financial Conduct Authority (FCA). It allows its customers to update their details, apply for new loans, and view their outstanding loan details – all on one platform.

How Does an Uncle Buck Loan Work?

The best thing about Uncle Buck loans is that they are fully operational online. This allows you to make applications online and make a decision immediately. The decision appears on the screen and not by email, making it even more efficient and saving time in a financial emergency. You can access your loans in one hour if your application was made between 7:00 am to 7:00 pm. The applications submitted after this timespan will get their loans the next day.

Before approving the loan, the lender will consider some factors, including your credit score. If you get a poor rating on your credit score, the loan will have a higher interest rate and little flexibility. In addition to the credit score, they will also check your monthly income to check your financial position and whether you will be able to repay the borrowed money or not.

If Uncle Buck does not approve your loan, they will pass your details to a third-party lender, but that will only happen if you get approved. This can help you find a lender better suited to your needs. You can apply to Uncle Buck again if your circumstances have changed. They do not charge anything for this service, but if the transfer is successful, they will get a commission.

How Much Can You Borrow with Uncle Buck Loans?

Uncle Buck loans range from 100 to 5000 pounds. The maximum loan the company provides its customers is 5000 pounds. However, first-time customers can only get a loan of 100 to 200 pounds.

Types of Loans Provided

Uncle Buck Loans offers two types of loans: payday loans and installment loans. Both of them are described below:

Payday Loans

Payday loans are usually short-term and need to be repaid on the borrower’s next payday. They are used to cover unexpected expenses that arise during the month before the borrower’s payday.

Installment Loans

These are particularly long-term loans that are to be repaid over several months. They are used to cover larger expenses and when the customer wants the repayment time to spread over a long duration.

Pros and Cons of Uncle Buck Loans

Everything has pros and cons, and both should be considered when getting a product or a service. Similarly, Uncle Buck has its pros and cons listed below:

Pros

- Uncle Buck Loans are direct lenders, and no third party is involved. You will get what you see.

- Payout processes take place 24/7

- No hidden costs are involved

- The prepayments are free of cost

- In case they decline your loan request, then with your approval, they send your details to other brokers or lenders to help you out.

- You may qualify for an interest rebate if you repay your loan before the due date.

- Funding is provided within one hour if the application was submitted in the given time frame.

- Their late payment fee is only 5 pounds, which is less than the standard late payment fee of 15 pounds.

Cons

- They offer no rollovers or loan extensions

- Their rates are comparatively high

- Uncle Buck has some negative reviews online

- The company provides low loan limits

- New customers get a loan of a maximum of 500 pounds

Loan Repayments

A payday loan must be repaid within 30 days, while installment loans can be repaid within 4-6 months. Their loans are more flexible than those of other companies providing these services. There are options to repay the loan before the due date without any charges. Early repayment can result in major savings on interest.

Individuals who qualify for Uncle Buck loans can set their preferred repayment dates. Most people choose the last day of the month for repayment. However, some people select the 25th of the month, the day they receive their salaries. It is completely up to you what date you choose. The lender will collect the payments using continuous payment authority (CPA).

It is a useful way to get recurring payments. This allows the lender to collect the repayment from your accounts automatically. You do not need to call the facilities for manual repayments. You will even have the facility to change the due dates or pause the recurring repayments just by calling the lender or the bank.

Loan Fees

Uncle Buck charges a fee in the form of interest on its loans. This interest varies and depends on the type of loan received and the repayment terms selected. Payday loans have a higher interest rate than installment loans. If the customer fails to repay on time, then a late fee is also charged to them. They charge an extra 5 pounds in case of a missed payment. The company sets a cap on the total interest fee that can be charged to the customer to prevent them from drowning in debt.

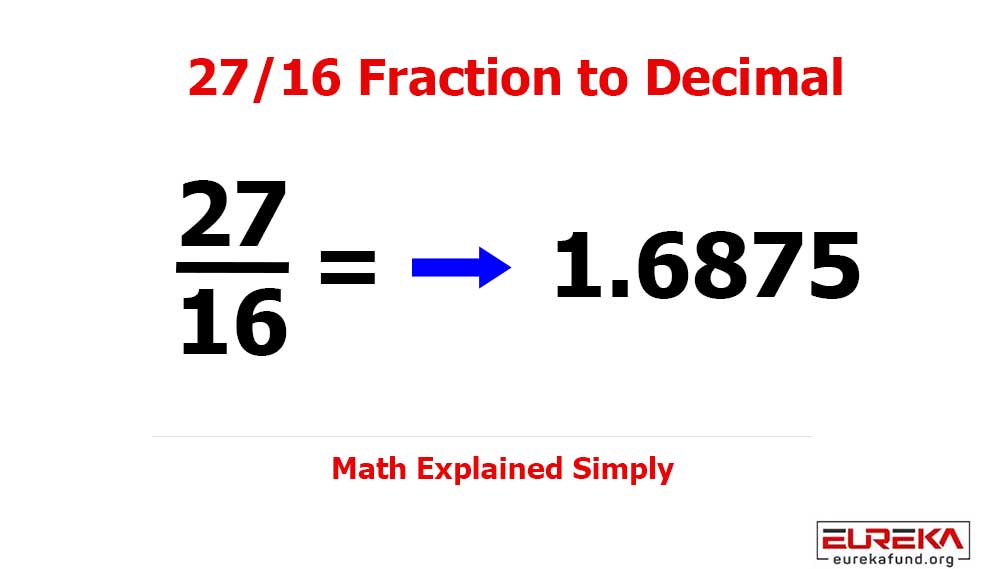

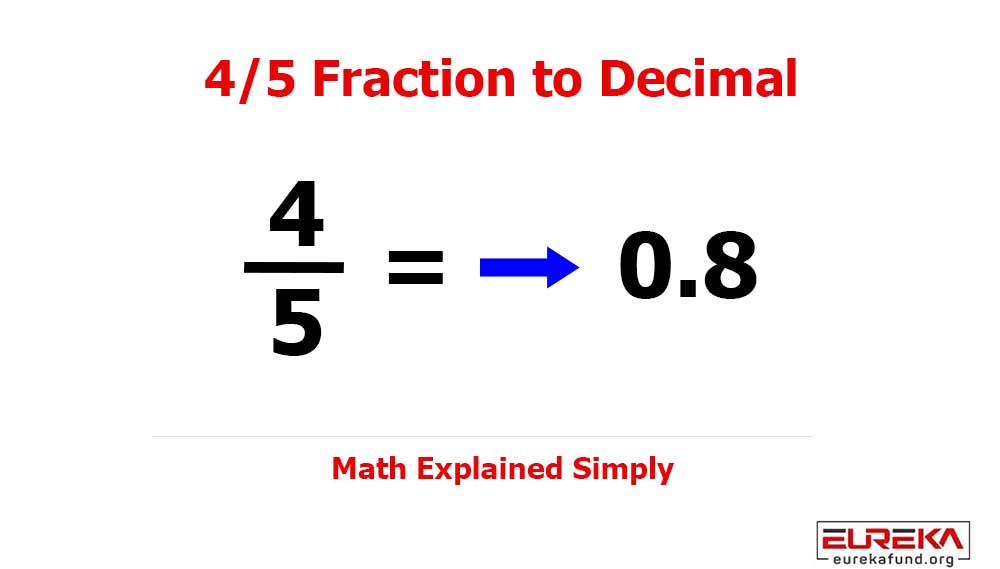

Some of the interest fees that the company charges are mentioned here:

- Late payment fee – £5

- Daily interest rate – 0.8%

- Maximum APR – 1,249%

- Arrangement fee – nil

- Early repayment fee – nil

Eligibility Criteria for Uncle Buck Loan

Qualifying for a loan from Uncle Buck is not that difficult. Some requirements need to be fulfilled to get approved for the loan. These requirements are enlisted here:

- You must be a permanent resident of the United Kingdom

- You must be 18 years old

- You must be employed

- You must have a regular income

- You must receive your salaries in your bank account

- You must possess a valid debit card for your registered bank account

- You must not have any management plans, IVAs, or bankruptcy

- You must have a valid email ID

- You must have a valid contact number

Loan Application Process

They provide an online application form on their official website. Customers just need to fill out this application and enter details such as bank information, monthly income and expenditures, and address history. They check these details to make sure that you are eligible for the loan. If the application gets approved, the loan will be transferred within 15 minutes.

Uncle Buck Loans Customer Service

Uncle Buck Loans has an efficient customer support service. Their customer service is available Monday through Friday from 8:00 a.m. to 8:00 p.m. and Saturdays from 9:00 a.m. to 5:00 p.m. They are available to answer all queries and questions regarding the loans. Customers can reach them via phone, email, or live chat. Another plus point is the comprehensive FAQ section on their website, which answers immediate and most common questions.

The company gets mixed reviews for its customer service. Out of a total of 1697 reviews on Trustpilot, Uncle Buck Loans get a rating of 7.5 out of 10, which is not so bad. Almost 69% of its total customers rate their services to be excellent but overall, the average rating is great.

However, some people have complained about experiencing unpleasant customer service. However, it should be noted that they have responded to all reviews on their platform, which gives them a good reputation.

Is Uncle Buck a Safe Option for Borrowing Money?

They are authorized and regulated by the Financial Conduct Authority (FCA). They are direct lenders and do not involve any third parties in the process which is why it is a safe option to choose them for getting loans. In addition to that, they keep your details and information very secure. Even if your loan request gets rejected, they take your approval before going to any third-party lenders. This shows their consideration for their user’s privacy.

How does Uncle Buck Deal with Defaulters?

Whenever you apply for a loan, you must have a repayment plan with you. But sometimes things do not go the way you plan them. Health complications, loss in business, or loss of a job can make you financially unstable, and you might not be able to repay your loans. Then, you must know how Uncle Buck deals with such situations.

If your monthly payment through continuous payment authority (CPA) fails, the company will inform you through SMS or email, or they might even call you. So, suppose you are in a financial crisis. In that case, you should talk to them and come up with a more manageable repayment plan, which involves breaking your installment into smaller amounts so that it becomes easier for you to pay them over an extended time. It should be noted that FCA freezes the interest to not more than half of the amount of the loan that you borrowed.

This change of repayment plan is only possible if you reach out to them within three days after the due date. After three days of the due date, the company will charge you a fee of 15 pounds. This fine will be combined with the outstanding balance and your interest rate will increase to 0.8%.

Uncle Buck involves external parties to collect debts in case you remain to stay unresponsive. But they will not take this step before issuing a final written notice to you. So, to avoid going through this trouble it is better to contact the company whenever you feel like you cannot pay back the loans within the due dates.

Conclusion

Uncle Buck Loans is a popular online platform for short-term money lending based in the United Kingdom. It is an FCA-authorized company. They actively deal with customer’s concerns, from applying to receiving the loans in your account, online. This approach has made this process fast and easy.

Only a few requirements must be fulfilled to qualify for the loan. However, if you do not qualify, the company will refer your case to other lenders and brokers. Once the application is approved, the money transfer takes 15 minutes. Undoubtedly, Uncle Buck Loans has become a safe and reliable option for anyone who wants quick access to cash.

FAQs

Can someone else repay on my behalf?

In some extreme cases, Uncle Buck accepts the repayment on your behalf from your relatives, such as your mother, father, siblings, or friends. But in such a case, you must call customer service to inform them and make an arrangement for this to happen. It must be noted that Uncle Buck will not accept any repayment from anyone else unless you authorize it.

What should I do if I change my mind after getting the loan?

If you change your mind after receiving the funds, you can withdraw from your agreement up to 14 days after receiving it. No reason is needed during this period, but you must give notice. After providing the notice, you will be required to repay the principal amount along with any accumulated interest within 30 days.

Which method is used to repay the loan?

Uncle Buck employs continuous payment authority for repayments. It withdraws the funds automatically from your account using the debit card information you provided during the application process.

What happened to Uncle Buck Loans?

Following the Financial Conduct Authority (FCA) audit, the company has brought in administrators and has stopped lending money. This happened because FCA had doubts regarding the company’s growth.

Who owns Uncle Buck Finance?

Uncle Buck Finance is owned by Steve Murray, the founder and senior partner of Uncle Buck Finance LLP.

How long should the loan term be?

The duration of the loan term completely depends upon the customer. However, Uncle Buck Loans’ loan term is between 4 and 6 months. If the customer feels that he can repay the amount in a shorter time, then it can benefit him in the sense that he will save the interest fees and reduce the total number of repayments.

For what purposes can I get a loan from Uncle Buck Loans?

You can get a loan for anything you desire, whether for a business or to pay bills. However, it should be noted that this type of short-term loan costs more than a regular loan, so it is better to get this loan only for a financial emergency, such as unexpected bills or for house and car repairs.