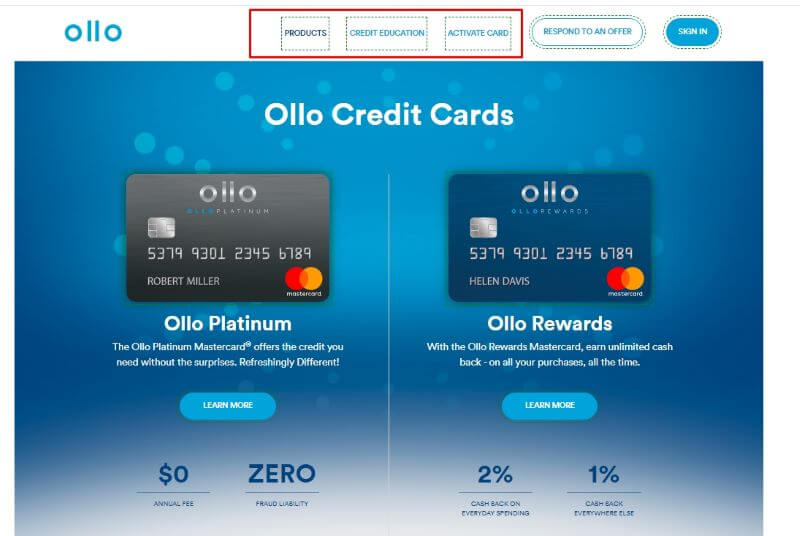

With so many credit cards on the market today, it can be hard to know which one is right for you. One popular credit card issuer that many consumers look to is Ollo. Ollo offers a variety of credit cards, each with unique benefits and rewards programs.

In this guide, we’ll provide an overview of Ollo credit cards, looking at the different card types they offer, rewards programs, fees, and other factors to consider to help you decide if an Ollo card is a good option for your financial needs.

Whether you’re interested in cash back, travel rewards, balance transfers, or building credit, Ollo likely has a card that can fit your goals. Read on to learn more about what Ollo credit cards have to offer.

What Bank Owns Ollo Credit Card

Ally Bank is the institution that issues the Ollo Platinum Mastercard. Ally Bank is a digital financial services company founded in 1919 and is FDIC-insured. Ollo itself is a brand of consumer credit cards launched in 2017 by Fair Square Financial Holdings. Fair Square Financial Holdings, the parent company, is based in Wilmington, Delaware, and emphasizes providing credit card products through technology and analytics-based underwriting.

It’s important to note that while Ally Bank issues the Ollo Platinum Mastercard, other Ollo credit cards may have different issuing banks. For accurate information, always refer to the specific terms and conditions of each Ollo credit card offer.

ollo’s Card Options

Ollo Platinum Mastercard

The Ollo Platinum Mastercard, tailored for individuals with good or decent credit, distinguishes itself with its credit-building focus and financial accessibility. Here are the key benefits:

- No Annual or Monthly Fees: Users enjoy a cost-effective credit-building solution without the burden of annual or monthly fees.

- Online and Mobile Access: Conveniently manage your account from anywhere with seamless online and mobile access.

- Cash Advances: Access cash up to your predetermined limit, providing financial flexibility when needed.

- Flexible Payment Options: Make payments easily through online channels or by calling the dedicated payment line at (877) 494-0020.

- Effortless Activation: Activate your card hassle-free by calling (877) 494-0020 or using the number on the back of your card.

- Fraud Protection: Benefit from built-in fraud protection to safeguard your financial transactions.

- 24/7 Customer Service: Access round-the-clock customer service for assistance and support.

Ollo Rewards Mastercard

The Ollo Rewards Mastercard stands out with its cashback program, providing 2% cash back on gas station, grocery store, and drugstore purchases and 1% cash back on all other transactions. Notably, the card is traveler-friendly and imposes no foreign transaction fees. Beyond its rewarding structure, the Ollo Rewards+ Mastercard offers additional advantages:

- 24/7 U.S.-based Customer Service: Enjoy round-the-clock customer support for any inquiries or assistance.

- Fast and Easy Online/Mobile Access: Manage your account conveniently through user-friendly online and mobile platforms.

- Zero Fraud Liability: Benefit from protection against unauthorized purchases, ensuring security.

- Instant Card Lock with Lock It Feature: Quickly secure your card if misplaced, providing added control.

- No Annual Fee: Save on annual costs associated with credit card ownership.

- No Foreign Transaction Fees: Travel without incurring extra charges for international purchases.

- No Over-the-Limit Fees: Enjoy financial flexibility without penalties for exceeding credit limits.

Ollo Optimum Mastercard

As a “supercharged” version of the Ollo Rewards card, the Optimum Mastercard combines lucrative cash-back opportunities with a range of user-friendly features. It stands out with exceptional benefits:

- 2.5% Cash Back: Earn an impressive 2.5% cash back on all purchases, providing substantial rewards on every transaction.

- No Reward Limits: Enjoy the flexibility of unlimited rewards, allowing you to accumulate cash back without any restrictions.

- Flexible Redemption: With no minimum redemption requirements, you have the freedom to redeem your rewards at any time.

- No Expiration Dates: Your earned rewards are yours to keep, as they do not come with any expiration dates.

- Fee-Free Advantage: Experience a fee-free journey with no over-the-limit fees, return payment fees, or foreign transaction fees.

- Rate Stability: Late payments won’t lead to rate hikes, ensuring a stable and predictable credit experience.

Ollo Credit Card Invitation Process

Ollo credit cards, including the Ollo Rewards Mastercard, operate on an invitation-only basis. Eligible individuals, often those with good credit scores reaching at least 700, are selected for consideration. This exclusivity aims to target applicants with a higher likelihood of creditworthiness.

How to Get Ollo Credit Card Invitation?

While Ollo’s invitation process is generally selective, individuals can take certain steps to enhance their chances of receiving an invitation:

- Ollo often targets individuals with good credit scores. So, aim to maintain a credit score of at least 700 or higher.

- Demonstrate responsible credit usage by making timely payments and keeping credit balances low.

- Monitor your credit report for accuracy and address any discrepancies promptly. A positive credit history can attract credit card offers.

- Opt to receive prescreened offers by visiting the official websites of major credit bureaus. This increases the likelihood of being identified as a potential candidate.

- Ensure your contact information with major credit bureaus is up-to-date. Credit card issuers use various channels, including mail and email, to send invitations.

- Visit Ollo’s official website and explore any prequalification tools or offers that may be available.

- If you’re interested in Ollo credit cards, consider applying for credit cards with similar credit requirements. Responsible credit usage might attract Ollo’s attention.

Ollo Credit Card Application Process

The application process for Ollo credit cards involves potential cardholders utilizing the provided reservation number and access code. These details are essential for completing the application and moving forward in the evaluation process. While the invitation signals a preapproval, the final approval is contingent on a comprehensive assessment of the applicant’s creditworthiness.

Annual Fees and Rewards

Understanding the annual fees and rewards is crucial for assessing the overall value of Ollo credit cards. Each card offers distinct features that are mentioned in the table below:

| Credit Card | Annual Fee | Creditworthiness Dependency | Rewards | Additional Information |

| Platinum Mastercard | None | Not applicable | No rewards | Straightforward option without additional perks |

| Rewards Mastercard | $0 to $39 | Dependent on creditworthiness | 2% cash back on specific purchases | Cash back program introduced for added benefits |

| Optimum Mastercard | None | For Ollo customers with the best credit scores | 2.5% unlimited cash back on all purchases | Designed for customers with excellent credit scores |

APR Considerations for Ollo Credit Cards

When evaluating Ollo credit cards, it’s essential to be mindful of the Annual Percentage Rate (APR), as it directly impacts the cost of carrying a balance. Below are the APR details for each card, along with key features to help you make an informed decision.

| Features | Platinum Mastercard | Rewards Mastercard | Optimum Mastercard |

| Standard Variable APR | 23.99%-28.99% | 23.99%-28.99% | 24.99% |

| Introductory APR | Introductory APRs may be offered | Introductory APRs may be offered | 0% Introductory APR for 15 months (if offered) |

| Annual Fee | None | $0-$39 | None |

| Cash Advance Fee | 5% or $10, whichever is greater | 5% or $10, whichever is greater | 5% or $10, whichever is greater |

| Balance Transfer Fee | 4% or $5, whichever is greater | 4% or $5, whichever is greater | 4% or $5, whichever is greater |

| Minimum Interest Charge | $1.50 | $1.50 | $1.50 |

| Additional Information | Pricing may vary; refer to the solicitation for details | Pricing may vary; refer to the solicitation for details | Pricing may vary; refer to the solicitation for details |

Ollo Card Customer Service

For assistance with your Ollo Credit Card, now managed by Ally, the following information can guide you through account management and address potential concerns:

Account Management

Ollo is now Ally, and you can conveniently manage your account by creating a profile on Ally’s official website. The platform provides tools and resources for effective account management.

Chargeback Initiatives

If you need to initiate a chargeback on an Ollo card transaction, you can do so within 90 days from the transaction date. Keep in mind that the resolution time for chargebacks may vary based on the specific details of the charge and the involved parties.

Customer Service Contact

For direct assistance and inquiries, you can contact Ollo card phone number at 00 1 516-224-5600. The customer service team can provide information, address concerns, and guide you through various aspects of your Ollo Credit Card.

Verdict

Ollo credit cards offer a range of options for consumers seeking rewards, cash back, balance transfers, or simply a path to build credit. With competitive features and benefits tailored to cardholders with good credit, Ollo aims to provide an accessible yet rewarding credit card experience. Carefully evaluate the annual fees, APRs, and rewards structures to determine which Ollo card aligns best with your financial profile and goals.

Overall, Ollo credit cards present an appealing choice for eligible applicants looking for a seamless digital credit card solution. With smart usage and timely payments, an Ollo card can effectively supplement your financial portfolio.