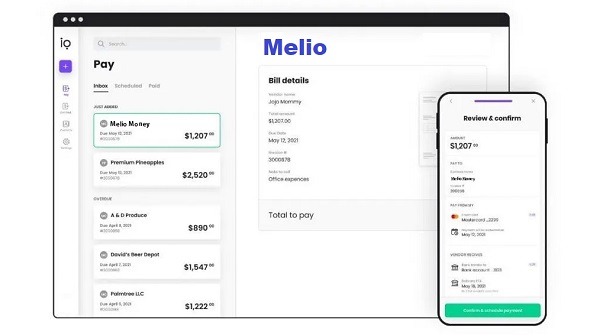

In today’s digital age, financial technology companies are finding innovative ways to facilitate payments and transactions. One such company making waves is Melio – an online payment platform designed for small and medium-sized businesses. Melio aims to modernize how businesses pay and get paid. But how does Melio make money through its services and offerings?

This article will help you examine Melio’s business model and revenue streams more closely. We’ll explore the services they provide, their target customers, pricing models, and more. Understanding Melio’s approach can provide insight into the evolution of digital payment solutions for SMBs and the fintech sector as a whole.

With easy integrations and flexible payment options, it’s clear why this startup has experienced rapid growth in just a few short years.

What is Melio?

Melio stands as a leading financial technology company dedicated to providing small businesses with an efficient platform for managing payments. Headquartered in New York, Melio strategically positions itself at the heart of global business. The company’s commitment extends to a Research and Development center in Tel Aviv, Israel, showcasing a dedication to technological innovation on a global scale.

Before the public launch in September 2020, Melio’s founders operated a small bookkeeping firm, immersing themselves in the challenges faced by SMBs and refining their approach through hands-on experience. Despite being rooted in Israel, Melio astutely targeted the expansive U.S. market, leading to rapid growth and strategic partnerships.

Who Owns Melio

Melio was founded in 2018 by CEO Matan Bar, CPO Ilan Atias, and CTO Ziv Paz. The company is headquartered in New York with additional offices in Colorado and Israel. Melio has received significant funding from top-tier investors including Accel, Aleph, Bessemer Venture Partners, Coatue Management, and General Catalyst. In January 2022, it announced a $110 million Series D funding round led by General Catalyst at a valuation of $4 billion.

To date, the company has raised over $506 million in funding. While Melio operates as an independent private company, its impressive growth and expanding network of high-profile investors have fueled speculation of a potential IPO.

How Does Melio Work

Melio simplifies the payment process for small businesses by providing various payment options. Here’s a step-by-step guide on how does it work:

- Initiate Payment: Users begin by initiating payments on Melio, accompanying their transactions with a modest upfront fee of 2.9%.

- Payment Transmission: Melio facilitates the seamless transmission of funds directly to vendors through ACH bank transfers, ensuring a secure and efficient transfer of funds.

- Same-Day Delivery Option: For transactions initiated before 2 PM ET on business days, Melio provides a same-day delivery option at no extra cost, expediting crucial financial transactions.

- Versatile Payment Methods: Small businesses can influence Melio to make payments using diverse methods, including ACH bank transfers, credit cards, or debit cards. This flexibility is particularly beneficial when dealing with vendors who typically accept checks.

How Does Melio Make Money

Melio has a multi-pronged approach to generating revenue and sustaining its operations as a payment platform tailored for small and medium-sized businesses. With this in mind, understanding how does Melio make money reveals key insights into its transaction fees, premium features, and strategic partnerships.

Transaction Fees

The core of Melio’s monetization strategy revolves around charging transaction fees for payments processed through its platform. For credit card payments, Melio charges a 2.9% transaction fee. This aligns with typical credit card processing fees, making it a compelling solution for SMBs. Additionally, Melio offers a premium plan for credit card transactions that provides expanded features and faster processing for a slightly higher 3.9% fee. Melio charges a flat fee of $1.50 for bank transfers per transaction. These transaction fees make up the bulk of Melio’s revenues.

Interest on Funds

In addition to transaction fees, Melio also generates revenue from the interest accumulated on user funds held in Melio accounts before payments are processed. While the interest earned on each individual user’s account balance is modest, the aggregate interest income across Melio’s entire user base results in a significant revenue stream. The longer the funds remain in Melio accounts, the more interest it earns.

Partner Programs

Melio has partnered with various software platforms like QuickBooks and Xero to offer its payment services to its extensive user bases. These partnerships allow Melio to access millions of new potential users. In exchange, Melio provides a revenue share from the payments processed through these integrated partnerships, which provides a steady stream of transaction volume and fees.

Referral Programs

To drive customer purchases, Melio offers a referral program that rewards existing users $25 for each new customer they refer while also giving the new user a $25 account credit. This creates an organic viral loop that helps Melio grow its user base through word-of-mouth recommendations. More users mean more transaction volume and long-term revenue generation.

Is Melio Secure

Yes, Melio is very secure. They take strong measures to protect your financial and personal information, ensuring it can’t be accessed without your permission. The platform uses advanced security features, including bank-level encryption, to protect your data. Additionally, Melio offers two-factor authentication, adding an extra layer of protection to your account. Your sensitive information is a top priority for Melio, and they work diligently to provide a secure environment for all users, emphasizing trust and data safety.

Melio Competitors

In the world of online payment platforms, Melio faces tough competition from other companies that also offer financial technology services. Let’s take a quick look at some of Melio’s main competitors.

BILL

BILL, like Melio, operates in the online payment space. It offers solutions tailored to businesses, assisting in bill payments and financial transactions. Known for its user-friendly interface, BILL provides tools for efficient invoice management and payment processing.

Wise

Wise, formerly known as TransferWise, specializes in international money transfers with transparent and cost-effective currency exchange rates. Users appreciate Wise for its straightforward fee structures and real exchange rates, especially beneficial for cross-border transactions.

Ramp

Ramp focuses on corporate cards and expense management, providing businesses with tools to streamline spending and gain insights into financial transactions. Notable for its budgeting and expense-tracking capabilities, Ramp aims to simplify financial management for businesses.

Brex

Brex targets startups and small businesses, offering corporate cards and a range of financial services to empower emerging enterprises. It stands out for its innovative approach, providing credit and financial solutions tailored to the unique needs of entrepreneurial ventures.

Payoneer

Payoneer specializes in facilitating cross-border payments, catering to businesses and professionals with global financial needs. Recognized for its versatility, Payoneer supports multiple currencies and provides solutions for international payments and transactions.

Wrapping Up

Melio has established itself as an innovative fintech company dedicated to streamlining payments for small and medium businesses. To understand how does Melio make money, one needs to look at its versatile payment options, competitive rates, and user-friendly interface that simplify transaction and cash flow management for SMBs.

With ample funding and strategic partnerships, Melio is poised for continued growth as it further cements itself as a leading financial services provider for the underserved SMB sector. Though a young company, Melio’s commitment to security, efficiency and customer service has fueled impressive early traction.