Navigating the path to earning a Certified Public Accountant (CPA) designation in the USA can be complex, particularly for international students.

This guide aims to simplify the process by clarifying CPA requirements for international students and highlighting the significant benefits and importance of this coveted credential.

Understanding CPA Exam Requirements

The CPA exam is a thorough assessment of one’s accounting knowledge and skills, determining their ability to work as a certified professional.

Specific Requirements for International Students

CPA requirements for international students are detailed, encompassing educational qualifications and specific identification protocols.

These prerequisites include an equivalent to a U.S. bachelor’s degree, a certain number of accounting and business courses, and a Social Security Number in some states.

State-By-State Variations in Requirements

However, it’s crucial to note that these requirements are not uniform across all U.S. states. State Boards of Accountancy have the liberty to set specific needs, leading to variations in education and residency requirements, among others.

International students should thoroughly research the specific requirements of the state where they intend to apply to ensure they meet the necessary criteria.

This nuanced process might seem daunting, but achieving the CPA designation is attainable with the proper understanding and preparation.

Educational Qualification Requirements for CPA

The educational prerequisites for taking the CPA exam may differ from state to state, as each state’s Board of Accountancy may have its regulations. Nonetheless, there are some shared requirements.

- Bachelor’s Degree: A minimum of a bachelor’s degree from an accredited college or university is typically required.

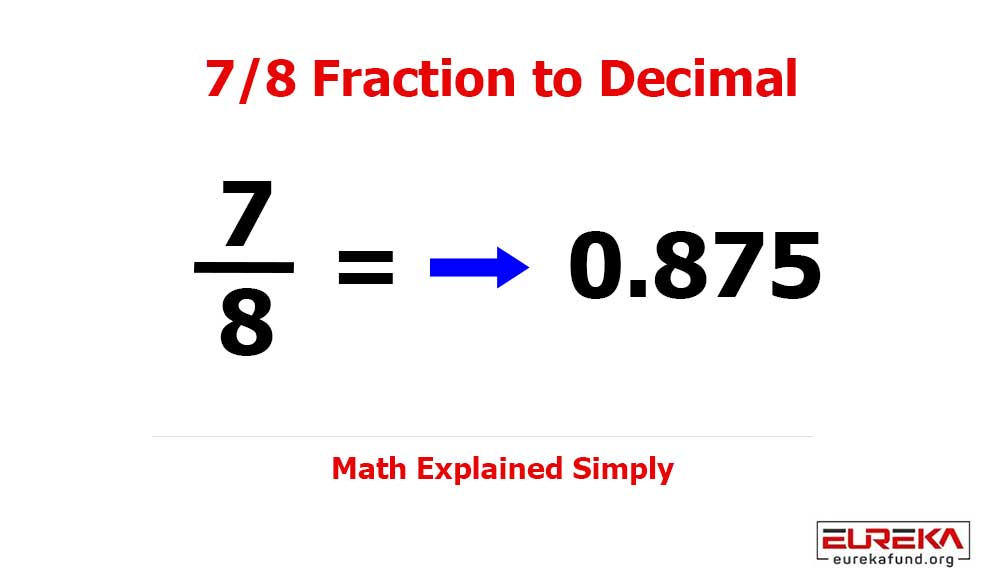

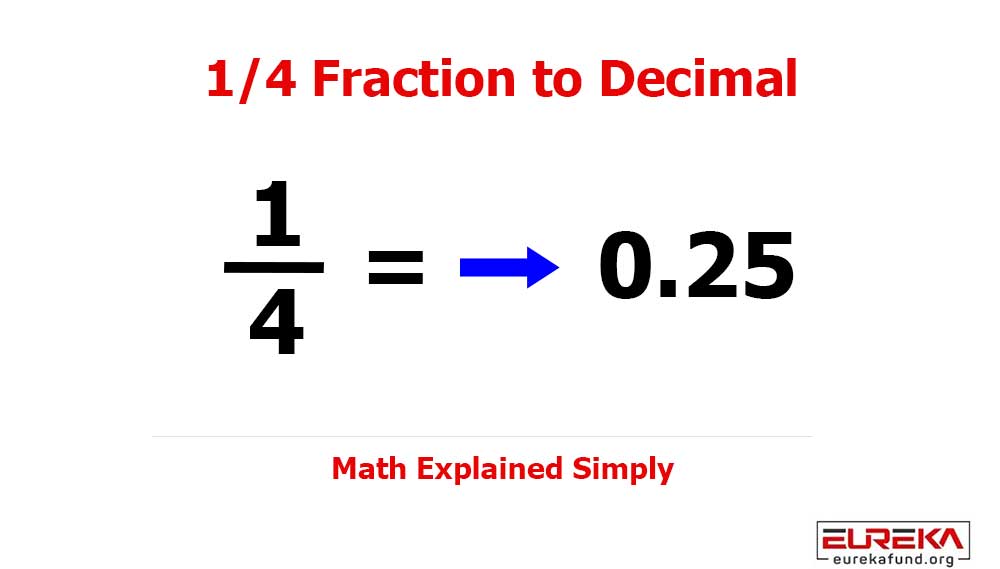

- 150 Semester Hours of Education: A candidate must complete 150 semester hours of college education in most U.S. states.

This is typically more than a standard four-year bachelor’s degree, often equating to a bachelor’s degree plus a master’s degree or an additional year of study.

Some states allow a certain amount of work experience to substitute for some of the required educational hours.

- Accounting Coursework: Candidates are typically required to complete a certain number of semester hours in accounting courses at the undergraduate or graduate level.

These courses must include financial, auditing, taxation, and managerial accounting.

- Business Coursework: Besides accounting coursework, candidates must complete several semester hours in business-related courses. These include business law, economics, finance, information systems, statistics, and business ethics.

- Ethics Coursework: Some states also require a specific course or examination on ethics for accountants.

Breakdown of Required Courses

The course breakdown is designed to provide a comprehensive accounting and business background. It typically requires a certain number of hours in accounting, such as financial accounting, auditing, taxation, and managerial accounting.

Additional hours are expected in business courses, including business law, management, economics, and finance.

Understanding and Evaluating Foreign Transcripts and Degrees

The foreign transcript evaluation for CPA eligibility involves determining whether an international degree is equivalent to a U.S. bachelor’s degree or higher and verifying that the coursework aligns with the CPA exam requirements.

This process is handled by evaluation services recognized by the state boards of accountancy. They review educational documents from non-U.S. institutions and provide a U.S. equivalency report. This report includes details on the degree equivalency, the course-by-course breakdown, and the total credit hours.

While the transcript evaluation can seem overwhelming, it’s a vital step to confirm the applicability of foreign education for CPA eligibility.

A clear understanding of the evaluation process can help streamline this journey for international students aspiring to become CPAs in the U.S. Knowing the specific academic requirements and how your educational background aligns with the first step towards achieving your CPA goal.

Common Challenges Faced by International Students

As international students navigate the path toward earning a CPA designation in the U.S., they often face unique challenges beyond meeting the CPA requirements and the process of foreign transcript evaluation for a CPA.

Language Barriers and Cultural Differences

Firstly, language barriers and cultural differences can present substantial obstacles. The CPA exam is administered in English, and the complex terminology can be daunting for non-native speakers.

Additionally, understanding the U.S. business culture, which is heavily integrated into the CPA exam, can be challenging.

Cost Considerations

Secondly, cost considerations pose another significant hurdle. The CPA exam isn’t inexpensive; there are fees for examination sections, study materials, and, potentially, travel. As the costs accumulate, financial planning becomes essential.

Maintaining Legal Status In The U.S. During the Study And Examination Period

Lastly, maintaining legal status in the U.S. during the study and examination period is crucial. Visa regulations can be complex, and staying compliant while managing study schedules requires careful planning and adherence to timelines.

Despite these challenges, many international students successfully navigate this journey every year, a testament to the attainability of the CPA designation with the right preparation and resources.

In Conclusion

Navigating CPA requirements for international students can be challenging, but success is attainable with determination and the right preparation. Pursuing a CPA designation significantly broadens career prospects and fosters professional growth.

Stay persistent, leverage available resources, and remember, every challenge overcome brings you one step closer to your CPA goal. Your journey may be challenging, but the reward is worth the effort.