Business owners decide to sell for many reasons, including a need for change, burnout, retirement, partnership problems, the desire to take profits at a high point, or another business opportunity. Whatever the reason(s) behind the sale of a business, frequent mistakes pop up. You don’t have to make these missteps, though! Keep an eye out for eight common blunders as you begin the process of selling your operations.

Eschewing Professional Help

Professional help goes a long way in ensuring a smooth, fair business sale. Now isn’t the time to handle matters that experts usually take care of.

For example, suppose you are in Florida. A merger and acquisition broker in Orlando can match your business with private and public acquirers and get you the best deal in a compact timeframe. You save money on numerous accounting and legal expenses with an M&A broker. Among other things, the brokers calculate your business’s pre-transaction value from multiple perspectives and structure the transaction to achieve optimal results.

Other helpful professionals when you sell a business include real estate agents, accountants, tax experts, lawyers, business valuation experts, and bankers. M&A brokers can fulfill some of these functions, too.

Not Qualifying Buyers Early

To save time, establish pre-qualification criteria for prospective buyers. Otherwise, you are likely to deal with people who are unable to follow through with buying the business. Pre-qualifying also ensures prospective buyers are legitimately interested. You won’t put your sensitive or private information into the hands of buyers who are not screened. It can be smart to go with a buyer, even a competitor, who is already in your line of business. If you use a broker, the broker does the pre-qualifying work for you.

Not Having a Transition Plan

You might think your obligations end the moment you reach a deal with a buyer. Not so quick. You do everyone, including yourself, a huge service by having at least a basic transition plan that clarifies how the business moves to the new owner. Transition plans make businesses more attractive to buyers and allow them to visualize the path forward. Also, if you’re someone who has poured years of sweat and effort into building your business, you probably want to see it continue to succeed. Without a solid transition plan, the business is at risk of withering after the sale completes.

Pricing Incorrectly

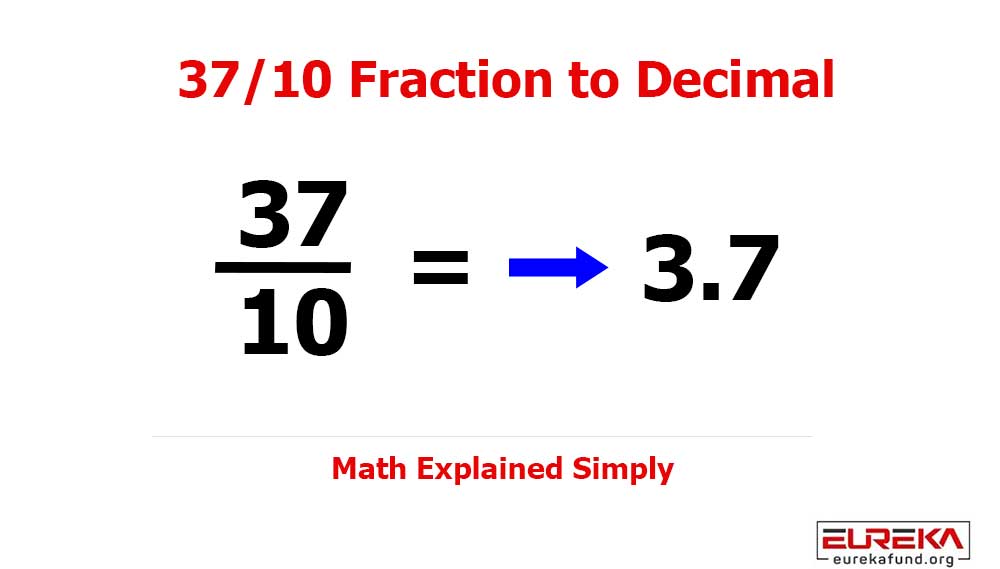

Price your business too low, and you lose money. Price is too high, buyers may not be interested and the process takes longer. A broker is a good person to help with pricing. For example, M&A brokers can determine how much a typical business in your industry is worth based on certain levels of sales.

Factors to consider when setting the market price for your business include assets (minus debts and liabilities), revenue, earnings multiples, discounted cash-flow analysis, unique geographical location, and other unique selling points.

Envision the future of your business when you calculate its true value. Help buyers comprehend the worth of what they are getting today.

Misrepresenting the Business

Not all misrepresentation is intentional, although it is sometimes. It’s somewhat common for people selling their business to misrepresent it for sentimental reasons if nothing else. These people have worked so hard to build their business and may not be fully aware of its flaws or weaknesses. Brokers and other neutral third parties help prevent accidental misrepresentation.

As for intentional misrepresentation, just don’t do it. It is dishonest and unethical and puts you at risk for legal trouble. Buyers may be able to see through the misrepresentation, too, and news has a way of spreading.

Making Questionable or Excessive Tax Deductions

Buyers and their representatives scour your business tax records in a sale. Questionable or excessive tax deductions can be a red flag even if you can explain them away legitimately. Whatever the case, tax deductions do lower the earnings of a business and beg for an explanation, so be careful with them.

Being Disorganized

Buyer due diligence is part of any sale, and good organization smooths out the process greatly. Have records related to board minutes, taxes, contracts, and, really, everything, filed and ready to go.

Unfairly Paid Employees

It looks bad if you pay your staffers significantly below market wages and bonuses. A similar idea applies if you ask one staffer to do the job of three. Check the salaries and job tasks of people in your area doing similar work to ensure your folks are fairly compensated. Bring these staffing considerations up to par, if applicable, to facilitate a good sale.

Selling a business is easier for some people than for others. The process is likely to be more straightforward the better organized you are and the more professional help you enlist. Even if you are sentimentally attached to the business and letting it go is proving difficult, getting all of your ducks in a row helps significantly.